The QRMP scheme provides to the taxpayers to file a return GSTR-3B on a quarterly basis and pay tax every month. 4 returns for 4 quarters.

What Is Invoice Furnishing Facility Iff Under Gst Accoxi

GST Return filing compliance burden for Tax Payer.

. GST instalments method pay quarterly and report annually Monthly GST reporting if your business has a GST turnover of 20 million or more. Added with various GST filing forms including GSTR-1 and GSTR-3B remains a greater challenge every month and quarter. The GST Council recommended the Quarterly Return Filing and Monthly Payment of Taxes or QRMP scheme under GST in its 42nd meeting held on 5th October 2020 as a business facilitation measure.

Be it due to invoice management invoice cancellation invoice reconciliation etc. Filing timely returns with the correct information is very important under GST to avoid high penalties and ensure a good GST rating. Administration Monthly GST return filing for businesses with turnover in excess of RM 5 million approximately S200000 Registration threshold is RM500000 Quarterly GST return filing unless monthly filing is requested by the business Registration threshold is S1 million.

Option to choose between Self Assessment Method Fixed Sum Method monthly depending upon fund availability. The reporting period a registrant has determines how often GSTHST returns are required to be prepared during the GSTHST year. This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya.

A monthly list of orders and distribution reports filed separately by sellers and vendors. Compliance cost for payment to accountant tax professional. Administration Monthly GST return filing for businesses with turnover in excess of RM 5 million approximately S200000 Registration threshold is RM500000 Quarterly GST return filing unless monthly filing is requested by the business Registration threshold is S1 million.

Taxable period is a regular interval period where a taxable person is liable to account and pay to the government his GST liability. 12 returns for 12 months. What is the impact of the change of gst to sst in malaysia.

Management of Working Capital. We also require some other businesses to report monthly we notify those that must do this. If you report and pay quarterly you use one of three reporting methods.

A return form that enables taxpayers to pay their tax liabilities on schedule. Taxpayers having aggregate turnover of upto Rs 5 crore rupees in the preceding Financial year. If your GST turnover is 20 million or more you must report and pay GST monthly and lodge your activity statement electronically through Online services for business.

Every registered person other than Composition taxpayer Nonresident taxable person Input Service Distributor Person deducting TDS E-commerce operator collecting TCS is required to file GSTR-1 monthly or quarterly. Incomplete data may result in invalid returns. Example if the taxable period.

Self Assessed Payment on monthly basis. Other businesses may choose to report GST monthly when their GST turnover is less. 4 returns for 4 quarters.

Actually existing goods and service tax gst system is replaced. When registering for a GSTHST account and in cases where a reporting period is not specified Canada Revenue Agency CRA will assign an. GSTHST registrants are required to file GSTHST returns on a monthly quarterly or annual basis.

Returns are to be filed in the subsequent months on a monthlyquarterlyannual basis. This scheme became effective from 1st January 2021. QRMP Scheme and Monthly Payment At Glance.

Thats what this guide is for. No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules. Requirement of gst registration and.

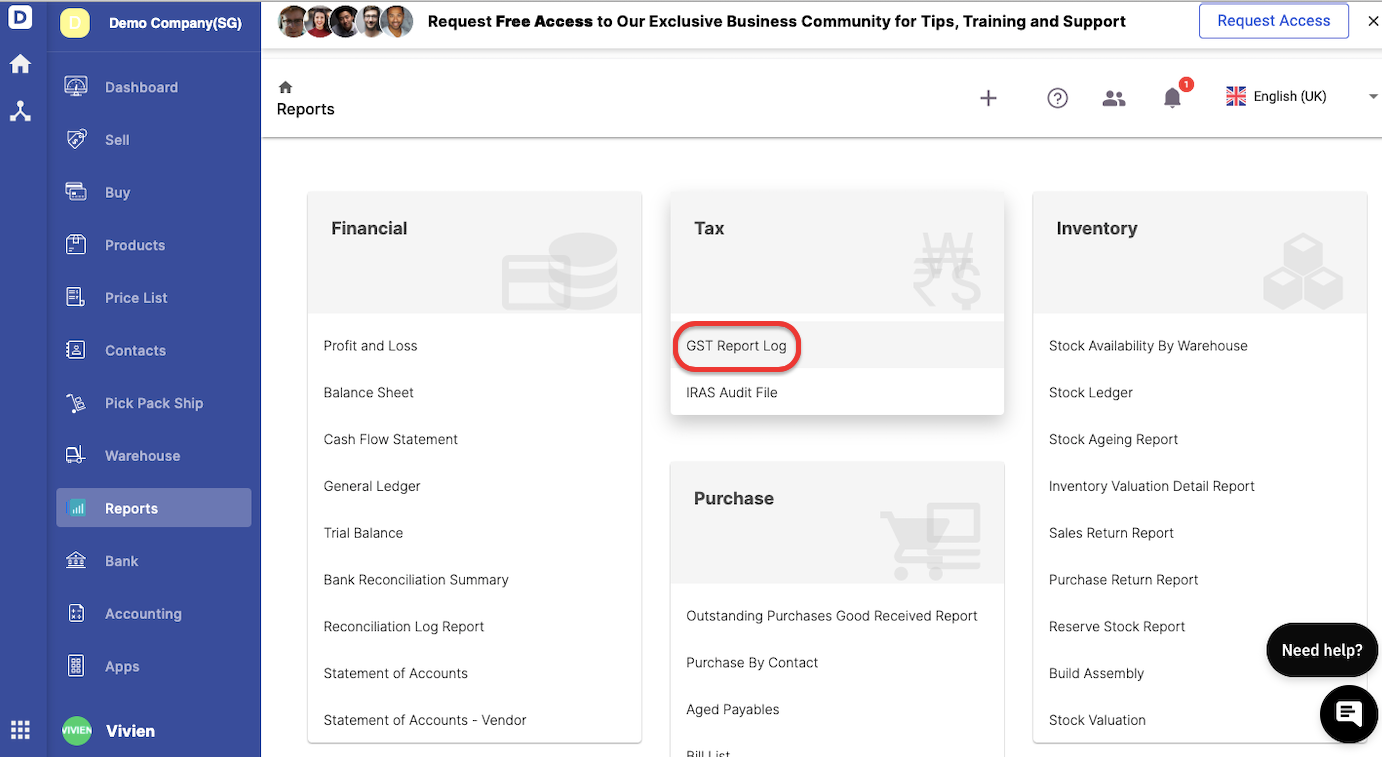

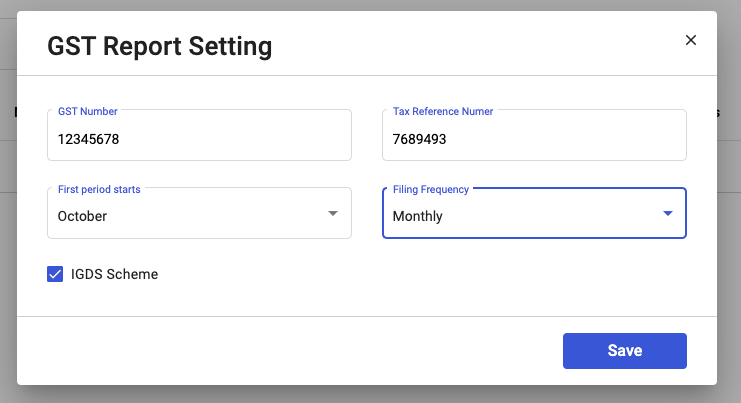

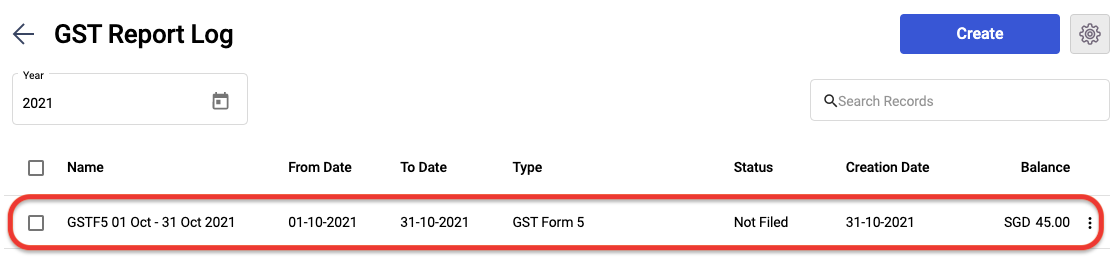

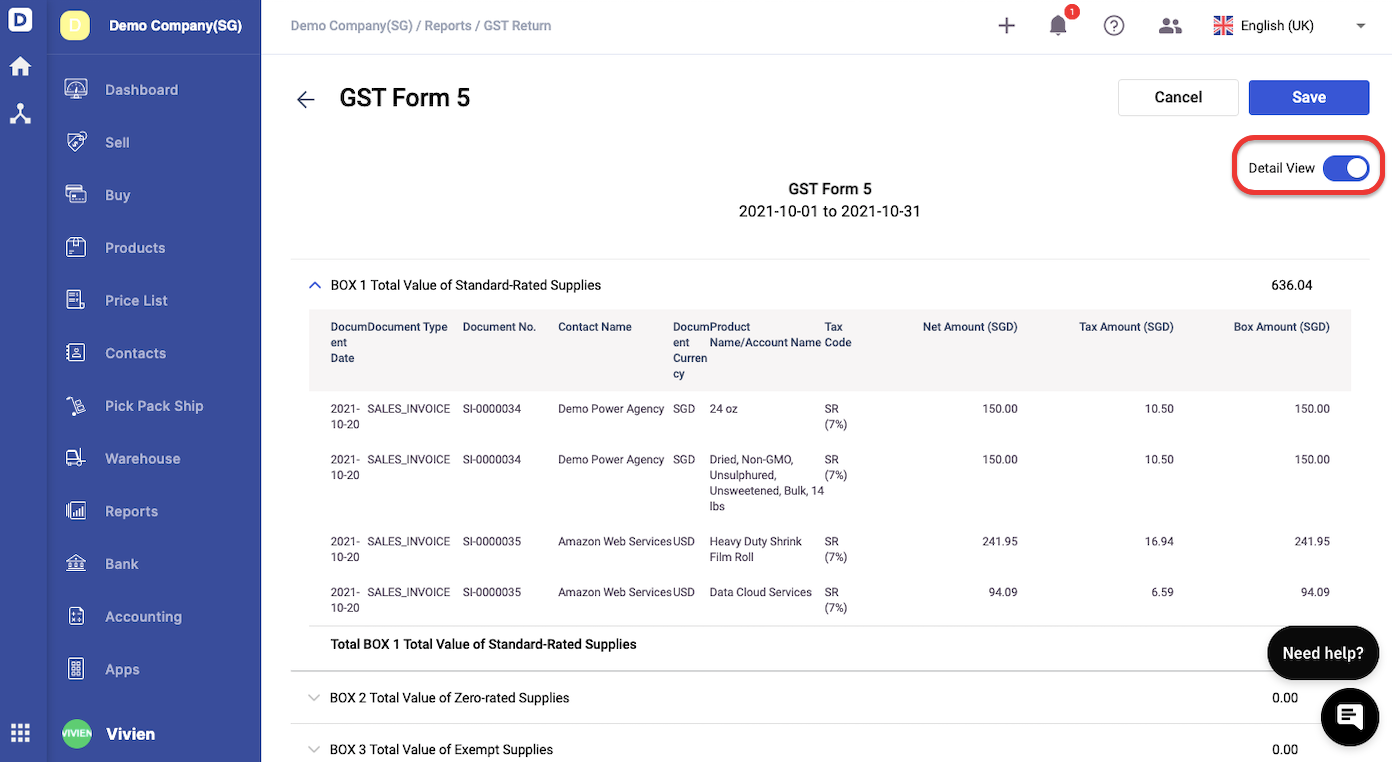

Creating monthly or quarterly gst return 03 automatically. As the same suggests Quarterly Return. Calculation Payment of tax.

GST Filing 2022- Quarterly and Monthly GST Return 2022 in Mawlai GST filing for businesses whether small or large remains always a challenge due to various issues. 12 returns for 12 months. GST returns must be submitted to the GST office not later than the last day of the following month after the end of the taxable period.

It was introduced to reduce the compliance burdens and promote ease-of-doing-business EODB. GSTR-1 is the details of outward supplies or sales made by the taxpayer during the period to business or consumers. Businesses that are registered under gst have to file the gst returns monthly quarterly and annually based on the.

Any taxpayer who has opted in for the GST Composition Scheme must file this form. Deadline for filing of the GST Returns and payment of GST is the last day of the month following the taxable period. Those companies that are achieving annual turnover above RM5 million the filing frequency will be increased to monthly.

Systems transition and preparedness. However a registrant may apply to be placed in. For annual turnover below RM5 million the frequency of filing is quarterly.

The standard taxable period is on quarterly basis. If your GST turnover is less than 20 million and we havent told you to report GST monthly you can report and pay GST quarterly.

Editable Yearly Monthly Cleaning Schedule Printable Month Etsy Australia

Electricity Tariff For S Pore Households Up By 9 9 In 2q

Harsh Mittal Cpa Ca Managing Partner Sga Globe Inc Linkedin

Statutory Compliance For The Month Of August 2022

Gstr 4 For Composition Scheme Explained Eztax

Saurabh Shah Proprietor Ambica Systems Linkedin

Gstn Issued Updated Gst Return Offline Tool For Invoice Furnishing Facility Iff With New Version V3 0 0 For Quarterly Filers A2z Taxcorp Llp

Online Tax Consultant Gst Return Filing Service In Local Company Id 22741010533

Gstr 4 For Composition Scheme Explained Eztax

Kartik Account Tax Solution Service Provider Of Gst Return Filling Monthly Or Quarterly Private Limited Pvt Ltd Registration Including Pf Esi From Delhi

How To Improve Healthcare Technology Management With A Modern Cmms Accruent

Gstn Issued Updated Gst Return Offline Tool For Invoice Furnishing Facility Iff With New Version V3 0 0 For Quarterly Filers A2z Taxcorp Llp